AI MLCC Market Surges with AI Server Growth

The AI MLCC market is experiencing unprecedented growth as artificial intelligence (AI) applications drive massive demand for high-performance multi-layer ceramic capacitors (MLCC). According to Murata, a leading global passive component manufacturer, a single NVIDIA GB300 server requires approximately 30,000 MLCCs, while an entire server rack can consume up to 440,000 MLCCs. Demand is expected to increase by about 3.3 times from 2025 to 2030, prompting Murata to revise its fiscal 2025 revenue forecasts upward. Samsung Electro-Mechanics is also expanding MLCC production for AI servers starting in 2026, while several other passive component manufacturers are reporting strong market signals from AI applications.

AI Servers Driving MLCC Consumption to New Levels

In the global passive component market, capacitors, inductors, and resistors account for nearly 90% of the total, with capacitors representing 65%, and within that, MLCCs hold the largest share, often referred to as the “industrial rice.” Primary applications include networking, automotive, power, and industrial control, with networking alone accounting for 42%. The rapid growth of AI servers and data centers is pushing MLCC consumption into the tens of thousands per unit, marking a new era for AI MLCC demand.

MLCC usage ranking across AI applications typically follows: AI servers > networking equipment > edge AI devices (industrial gateways, cameras) > AI PCs/AI smartphones. An AI smartphone requires only about 1,000–1,500 MLCCs, an AI PC 1,800–2,500, whereas AI servers require tens of thousands. Murata notes that the 30,000 MLCCs in a GB300 server equate to roughly 30 times a smartphone’s usage and three times an automotive application. As GPU and HBM counts increase, MLCC consumption per server rack is expected to grow from 48,000 in 2022 to 4.3 million by 2027, nearly a 90-fold increase. This surge is driving the AI MLCC market in terms of both volume and value.

Functions of MLCCs in AI Servers

In AI server power systems, MLCCs play critical roles in decoupling, filtering, and energy storage, ensuring power stability and fast transient response. In high-power, high-transient load environments, a failed or improperly selected MLCC can compromise GPU stability and delay system validation. AI servers require smaller, higher-capacity, and highly reliable MLCCs, making them one of the top three cost components in server BOMs. For example, NVL36 and NVL72 servers use approximately 234,000 and 441,000 high-end MLCCs, respectively, with per-server MLCC costs reaching $2,500–$4,600.

The global MLCC market is projected to reach $27.25 billion in 2025 and $61.12 billion by 2030, with a CAGR of 17.53%, driven by AI servers, EVs, and 5G infrastructure. Other passive components, including resistors, inductors, and alternative capacitors, remain essential for voltage stability, signal integrity, and EMI suppression.

Leading Suppliers Dominate the AI MLCC Market

The MLCC market is highly concentrated, with Murata, Samsung Electro-Mechanics, and Taiyo Yuden controlling the majority of global production and pricing power. Proprietary technologies in ceramic powders, multilayer printing, and termination materials create high barriers to entry, ensuring that leading suppliers maintain dominance in high-performance AI MLCCs.

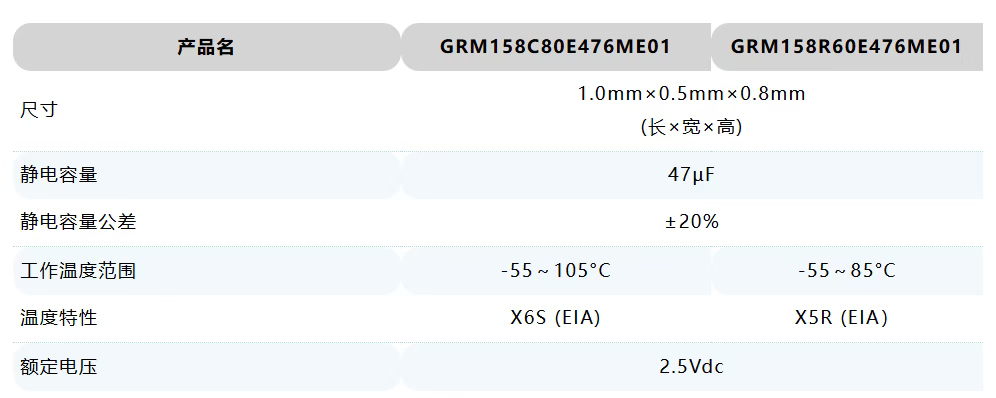

High-performance AI servers require MLCCs with higher capacitance (≥1 µF), high-temperature tolerance (X7S/X7R), low ESR/ESL, and smaller package sizes like 0402 and 0201. Murata’s 2025 mass production of 0402 (1.0mm × 0.5mm) MLCCs with 47 µF capacitance (Like (GRM158C80E476ME01 / GRM158R60E476ME01), rated up to 105°C, demonstrates the capability to support high-density AI server applications and data center infrastructure. Murata holds 45% of the global AI server MLCC market, with Samsung at 39%.

Market Trends and Company Developments

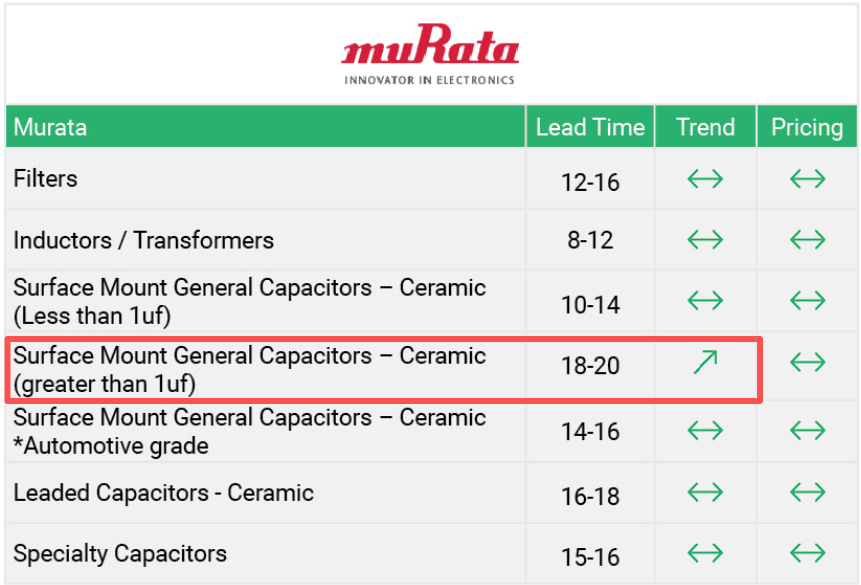

Murata raised its fiscal 2025 revenue forecast from ¥1.64 trillion to ¥1.74 trillion, with operating profit increasing from ¥220 billion to ¥280 billion. MLCC demand for AI servers is expected to grow at a CAGR of 30%, with projected needs in 2030 exceeding three times that of 2025.

Samsung Electro-Mechanics reported Q3 2025 revenue of KRW 2.889 trillion and operating profit of KRW 260.3 billion, driven by AI, automotive, and high-end server demand. Samsung plans to expand MLCC capacity for AI servers starting in 2026. Other Japanese suppliers such as Taiyo Yuden and TDK are also releasing MLCC solutions tailored for AI server power supplies, reinforcing the AI MLCC supply chain.

Taiwanese Suppliers Benefit from AI MLCC Demand

Taiwanese companies like Yageo and Walsin are also capitalizing on AI demand. Yageo is a major supplier of X6S MLCCs for AI servers and has integrated into NVIDIA’s supply chain through contract manufacturing. In 2025, Yageo reported revenue of NT$132.93 billion, up 9.3% YoY, with AI-related revenue accounting for 10–12%.

Walsin focuses on tantalum capacitors, inductors, magnetic components, and general-purpose MLCCs. AI-related revenue accounts for approximately 10%, supplying EMS and power solution providers. AI-driven applications allow Walsin to enhance product specifications, improving margins while supporting continuous growth in 2026.

Overall, AI server demand for high-performance MLCCs is concentrating the market toward high-end suppliers, with Japanese and Korean companies leading in capacitance, miniaturization, and high-temperature tolerance, while Taiwanese firms capture niche opportunities in the supply chain. The AI MLCC market is poised for continued growth in the coming years.

Conclusion

The explosive demand for AI MLCCs across global AI server deployments highlights the need for reliable, high-performance capacitors. Companies looking to scale AI hardware can rely on suppliers like 7SEtronic, which offers a broad range of MLCCs, tantalum capacitors, resistors, and inductors suitable for AI server applications and other high-performance electronics.

FAQs

Q1: Why do AI servers require so many MLCCs?

AI servers operate at high power with fast transient loads, requiring thousands to millions of MLCCs per server rack to stabilize voltage, filter noise, and store energy. Proper MLCC selection ensures GPU stability and reliable system operation.

Q2: What specifications are critical for AI MLCCs?

AI MLCCs need high capacitance (≥1 µF), high-temperature tolerance (X7S/X7R), low ESR/ESL, and small package sizes (0402, 0201) to handle dense, high-performance server layouts.

Q3: Who are the leading suppliers of AI MLCCs?

Leading suppliers include Murata, Samsung Electro-Mechanics, Taiyo Yuden, with Taiwanese companies like Yageo and Walsin serving specialized AI server applications. 7SEtronic also provides a comprehensive range of MLCCs and related passive components suitable for AI applications.

For more information and to review our available inventory, please contact our team for detailed pricing, current stock levels, and any additional technical support you may need.

You can find more component guides and application notes in our Component Technical Guides section: