Since late last year, discussions about DRAM price increases have moved beyond supply chain news and started affecting everyday hardware decisions.

Consumers feel it in smartphones, laptops, and desktop PCs. Even with promotions and subsidies, final prices often exceed previous levels. Some buyers noticed overnight price jumps of hundreds of dollars.

High-capacity server DRAM has become noticeably expensive. Bulk orders of DDR5 memory can now cost as much as premium real estate.

The impact reaches beyond computers and phones. Tablets, smart TVs, wearables, wireless earbuds, drones, and car infotainment systems all rely on DRAM. When memory pricing rises, manufacturers have limited room to absorb costs.

This article covers:

- Which devices and manufacturers are already affected by rising DRAM market trends

- How significant the current DRAM price increase is

- Why this trend is structural

- What smaller overseas factories should consider next

1. Smartphones, PCs, and Automobiles: Where Memory Costs Are Showing Up

Smartphones See the First Price Pressure

By Q4 2025, after nearly a year of DRAM market shifts, smartphone makers began reporting increased costs.

During Xiaomi’s earnings call, executives explained that the current memory trend is driven more by AI-related HBM demand than typical consumer electronics cycles. To manage DDR4/DDR5 pricing fluctuations, Xiaomi signed long-term supply agreements and indicated that product price adjustments would be needed.

Shortly afterward, flagship smartphones saw price increases, with memory costs cited as a main factor. Other brands followed, adjusting prices for mid-range and flagship models, and some canceled launches due to higher DRAM price.

According to IDC, memory now accounts for roughly 20% of a smartphone’s BOM, compared with 10–15% before. In lower-end devices, DRAM price can reach 30%, leaving minimal margins.

PC and Laptop Manufacturers Adjust Prices

PC and laptop brands also felt the pressure. Global manufacturers including HP, Dell, Lenovo, ASUS, and Acer implemented or announced price increases.

HP noted that memory alone accounts for 15–18% of a PC’s cost and that rising DRAM price would force changes in product options and pricing.

Dell observed that memory prices rose faster than ever before, with enterprise PC prices increasing up to 30%, depending on contracts. Lenovo informed customers that new pricing would start in 2026, encouraging early orders to avoid memory supply chain risks.

ASUS and Acer stated that product pricing would reflect DDR5 pricing changes, with adjustments planned throughout 2026.

Apple, Samsung, and the Automotive Sector Report Pressure

Apple’s U.S. site shows extended delivery times for some MacBook models. While product updates are a factor, allocation limits and higher DRAM price also play a role.

Samsung, the world’s largest memory maker, confirmed that ongoing DRAM shortages may push prices up across the electronics industry, including its own products.

Automotive companies are feeling similar effects. Analysts suggest that rising memory costs could surpass raw materials as the main expense in 2026. S&P Global Mobility notes that capacity shifts toward AI workloads may trigger shortages similar to past automotive chip crises.

2. How Rising Memory Costs Affect Procurement

Spot Market vs Contract Prices

Buyers face a gap between spot market pricing and long-term contract pricing.

Spot prices reflect short-term availability and react quickly to inventory changes or urgent projects. Contract pricing relies on forecasts, commitments, and long-term agreements.

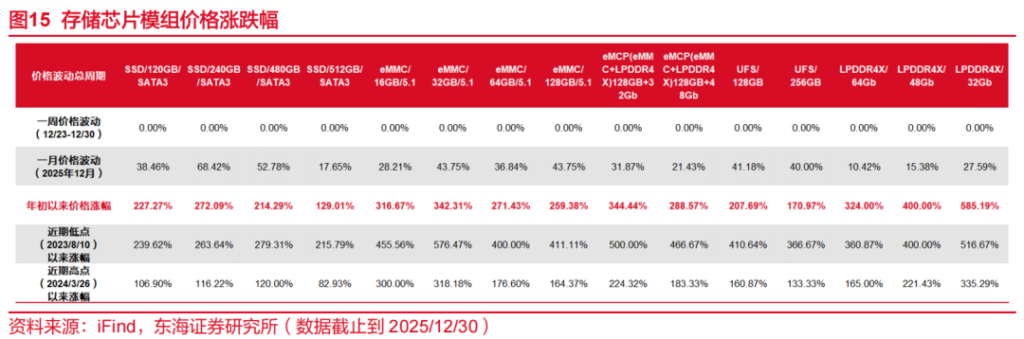

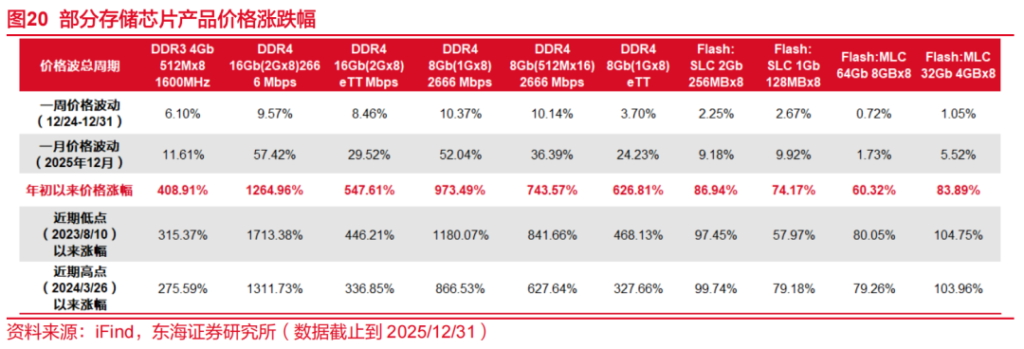

Currently, spot prices are volatile, especially for DDR4 components with shrinking production. Contract prices rise more slowly but are trending upward as suppliers regain leverage.

For smaller manufacturers, balancing these channels is a key sourcing decision.

DDR4 and DDR5 Pricing in 2026

DDR4 remains common in industrial equipment, networking, and embedded devices. As production shifts toward DDR5, DDR4 supply is tightening.

DDR5 prices depend on qualification cycles, platform compatibility, and vendor options. Buyers moving to DDR5 face longer lead times and higher minimum order requirements.

Procurement teams must weigh not just unit costs but also availability and redesign risks.

Practical Strategies Amid Rising DRAM Price

Memory suppliers are less tolerant of last-minute orders. Vendors prefer customers with steady forecasts, realistic volumes, and clear applications.

This means access to competitive pricing depends on transparency, alternative sources, and quick response to market openings.

Working with distributors that track market trends and offer flexible sourcing helps smaller factories. 7setronic can support buyers with market-driven sourcing options, cross-brand alternatives, and realistic lead-time guidance in line with current memory conditions.

3. Impact on Manufacturers and End Products

As low-cost inventory is used up, higher DRAM price affect finished product costs. When prices exceed what buyers can handle, resistance grows.

IDC predicts that 2026 global smartphone shipments may drop by 5% and PC shipments by 9%. For midstream suppliers, tighter margins increase competition, risk of idle production, and potential price battles.

Monitoring DDR4/DDR5 pricing, spot market conditions, and contract pricing allows manufacturers to plan effectively. Partnering with multiple suppliers ensures alternative configurations and continuity despite volatile memory pricing.

Conclusion

Micron expects high-end memory shortages to continue beyond 2028. Manufacturers cannot wait for prices to drop—they must manage costs now.

Early insight into DRAM price, memory allocation, and pricing options helps reduce uncertainty. Collaborating with 7setronic gives practical sourcing guidance, including alternative memory solutions and up-to-date quotations.

FAQ

Q1: Will DRAM prices keep rising in 2026?

Modest increases are likely, driven by supply constraints and AI demand rather than speculative spikes.

Q2: Is DDR4 still reliable for production?

Yes, but supply may tighten. Plan secondary sources or lifetime buys.

Q3: How can smaller manufacturers reduce sourcing risk?

Work with flexible suppliers, validate alternatives, and avoid last-minute spot purchases.

Recommended reading: