Entering January, the electronic components spot market did not experience the typical “post-holiday slowdown.” Instead, the NOR Flash price trend continued upward, alongside rising demand for memory devices and motion sensors. From RFQ frequency and spot circulation speed to actual transaction prices, several key components showed clear structural price increases.

This ongoing NOR Flash price trend is not driven by a single brand or short-term market sentiment. Rather, it reflects a combination of demand recovery, capacity adjustments, and expanding downstream applications. In consumer electronics, wearables, industrial control, and certain automotive segments, buyers are increasingly prioritizing supply continuity and long-term availability over short-term low pricing.

Based on real market feedback from January, we have summarized seven chip models with noticeably rising market interest, several of which directly reflect the current NOR Flash price trend. This content is for industry reference only and does not constitute trading advice.

- The soaring NOR Flash prices: “W25Q128JV / W25Q64JV”

- The skyrocketing prices of motion trackers: “ICM-42688-P / ICM-42670-P”

- The booming DDR3: “MT41K256M16TW-107:P”

- The expensive DDR5: “H5CG48AGBDX018N”

- The consistently popular eMMC: “KLM8G1GETF-B041”

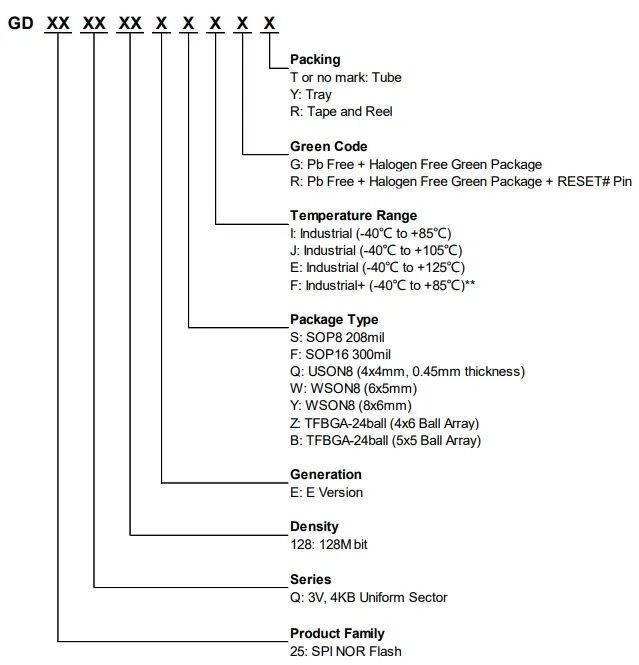

- The world’s second-largest NOR Flash manufacturer: “GD25Q128ESIGR”

- ST MEMS accelerometer: “LIS3DHTR”

NO.1 Intensifying NOR Flash

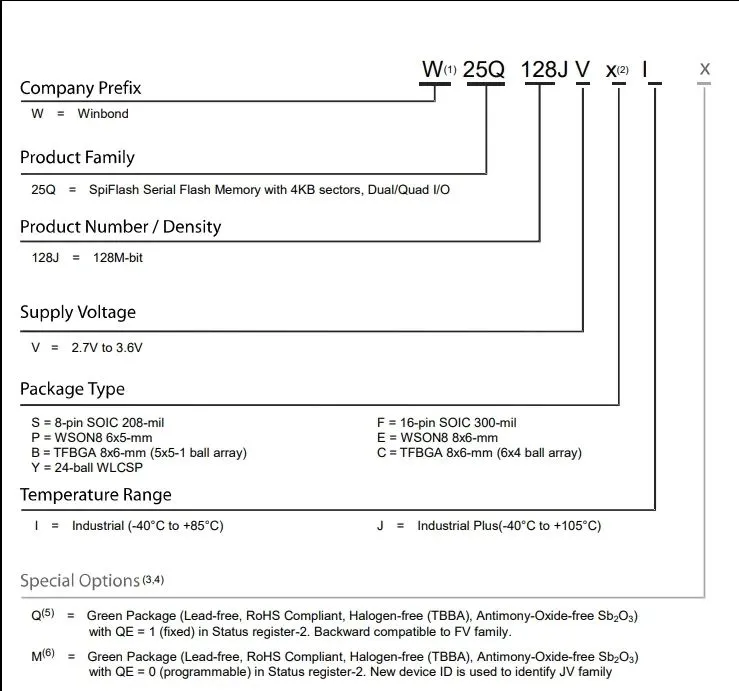

W25Q128JV / W25Q64JV | NOR Flash Price Trend Continues Upward

In January, W25Q128JVSIQ and W25Q64JVSSIQ saw further increases in market activity, becoming some of the most representative models within the current NOR Flash price trend. Both buying and selling inquiries increased significantly in the spot market.

- W25Q128JVSIQ:

Price rose from around RMB 6 last month to RMB 8–10 - W25Q64JVSSIQ:

Price increased from around RMB 3 to RMB 5–8

From a pricing perspective, these models clearly illustrate the core characteristics of today’s mainstream NOR Flash price trend: stable demand, tightening supply, and increasing price elasticity.

W25Q128JV (128M-bit) and W25Q64JV (64M-bit) are high-integration serial NOR Flash devices designed for systems with limited space, pin count, and power budgets. Their flexible packaging and strong compatibility make them widely used in wearables, industrial equipment, and automotive-related applications, all of which continue to support the current NOR Flash price trend.

Supply-side update:

According to Taiwanese media, Winbond plans to expand its NOR Flash wafer starts from approximately 25,000 wafers per month by the end of 2025 to around 30,000 wafers per month by mid-2026, targeting demand from industrial, automotive, and communications applications. As several competitors adjust product portfolios and reduce related supply, Winbond’s market position strengthens further, reinforcing expectations around the ongoing NOR Flash price trend.

NO.2 Rapidly Rising Motion Trackers

ICM-42688-P / ICM-42670-P | Expanding Demand

In January, ICM-42688-P remained highly active, while ICM-42670-P also gained momentum. This mirrors the broader recovery seen in storage markets alongside the NOR Flash price trend.

- ICM-42688-P:

Price surged from around RMB 30 to RMB 50–60, with some quotes exceeding RMB 70 - ICM-42670-P:

Typical pricing rose sharply from RMB 5–6 to RMB 15–16

ICM-42688-P is a 6-axis MEMS IMU from TDK InvenSense, integrating a 3-axis gyroscope and 3-axis accelerometer. It is widely used in AR/VR, wearables, robotics, and IoT applications, which are also key downstream drivers of NOR Flash demand.

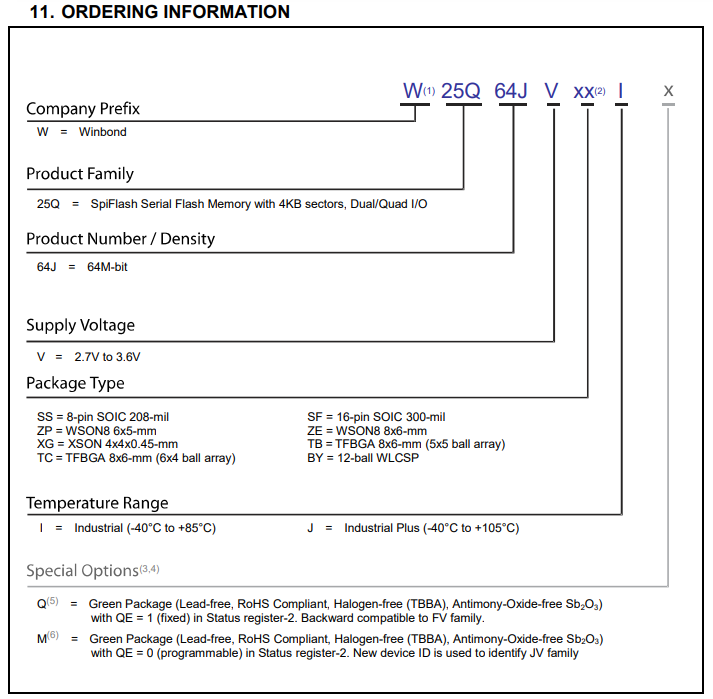

NO.3 DDR3 Back in the Spotlight

MT41K256M16TW-107:P | Approaching RMB 30

In January, MT41K256M16TW-107:P continued to gain traction:

- Price increased from just over RMB 20 to around RMB 30

In many industrial and embedded systems, DDR3 and NOR Flash are still commonly paired. As DDR3 pricing rises, customers are paying closer attention to overall BOM stability, indirectly increasing sensitivity to the NOR Flash price trend as well.

NO.4 High-Priced DDR5

H5CG48AGBDX018N | Strong and Sustained Price Increases

H5CG48AGBDX018N has shown one of the most dramatic price movements among memory components:

- Previously around RMB 46

- Surged to over RMB 300 starting November 2025

- January 2026 quotes reached approximately USD 56 (≈ RMB 390)

Compared with the sharp volatility of DDR5, the current NOR Flash price trend remains more predictable, which is why many customers are prioritizing early allocation of NOR Flash resources in cost planning.

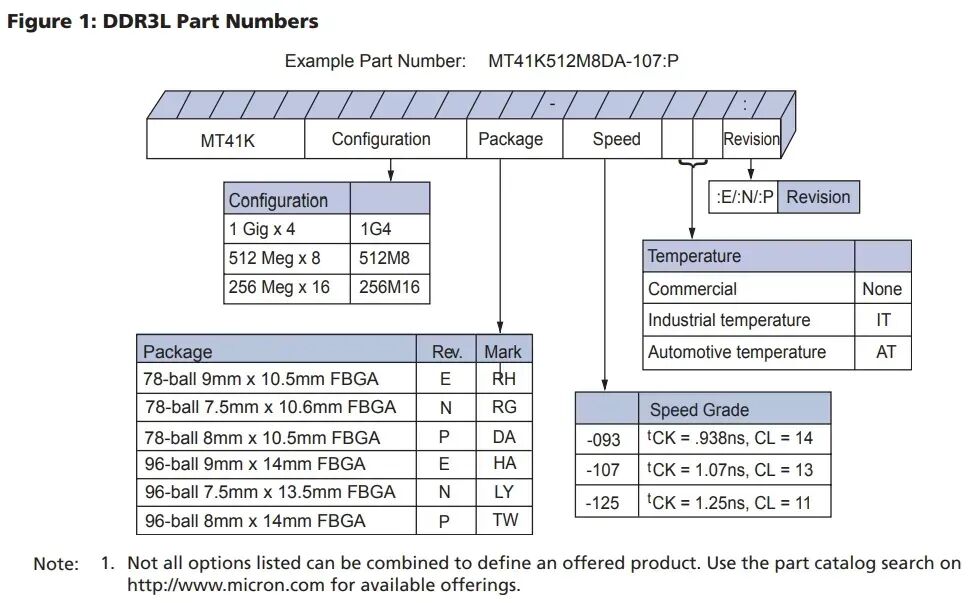

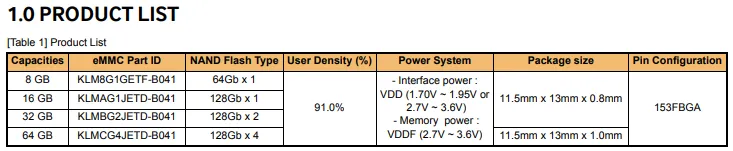

NO.5 Persistently Rising eMMC

KLM8G1GETF-B041 | Prices Double, Demand Remains

In January, KLM8G1GETF-B041 increased from RMB 70–80 to around RMB 120.

In embedded systems, eMMC and NOR Flash serve different storage roles, and their simultaneous price increases are pushing customers to reassess overall storage architecture rather than focusing on a single NOR Flash price trend.

NO.6 The World’s Second-Largest NOR Flash Supplier

GD25Q128ESIGR | Another Validation of the NOR Flash Price Trend

- Price increased from around RMB 4 to RMB 4–6

- Typical historical pricing was just above RMB 2

GD25Q128ESIGR is a 128Mbit SPI NOR Flash from GigaDevice. Its price movement aligns closely with Winbond’s W25Q series, jointly confirming the upward shift in the mainstream NOR Flash price trend.

This model shares the same capacity as W25Q128JVSIM (128Mb / 16MB) and can serve as a compatible alternative in certain designs, making it a common risk-mitigation option amid NOR Flash price trend fluctuations.

NO.7 ST MEMS Accelerometer

LIS3DHTR | Demand Recovery Supports Higher Pricing

After a strong cycle in 2024, LIS3DHTR saw renewed momentum toward the end of 2025. While activity softened slightly in January, pricing remains elevated:

- Typical price: RMB 1.7–2

- Current price: RMB 2–2.5

ST recently noted signs of recovery in consumer electronics demand in its financial report. Historically, such recoveries tend to appear first in MEMS sensors and NOR Flash price trend movements before spreading to higher-end components.

Conclusion (Trends & Takeaways)

Overall, January market data shows that the NOR Flash price trend is not an isolated phenomenon, but part of a broader structural shift across embedded memory and sensor components. Together with DDR, eMMC, and MEMS devices, NOR Flash reflects a coordinated recovery in downstream demand.

For small and mid-sized overseas manufacturers, rather than passively absorbing NOR Flash price trend fluctuations, it is more practical to evaluate supply stability, alternative options, and long-term delivery capability in advance.

In real projects, early model selection, phased purchasing, and structured delivery planning often provide better cost control than simply chasing the lowest price.

If you are currently assessing spot availability, NOR Flash price trend risks, or alternative strategies for any of the models mentioned above, deeper discussion based on your application scenario can help clarify feasible options.

FAQ

Q1: Is the current NOR Flash price trend suitable for long-term projects?

A: It depends on product lifecycle and supply stability. Some models are better secured through phased allocation.

Q2: Are there viable alternatives amid NOR Flash price increases?

A: In many cases, yes. Compatibility must be verified for voltage, command sets, and certifications.

Q3: How can buyers reduce risks from the NOR Flash price trend?

A: Early demand planning, multi-brand evaluation, and cooperation with suppliers holding spot inventory.

Inquiry Guidance

As a long-term supplier serving overseas electronics manufacturers, 7SEtronic continuously tracks the NOR Flash price trend and related memory market changes. We support customers in evaluating spot availability, pricing ranges, and substitution strategies to help ensure stable project delivery.